Are you planning to travel and shop in Thailand and concern about what is tax refund in Thailand, how does tax refund work in Thailand, how much tax refund will I get in Thailand, how much is tax refund in Thailand, how to claim VAT refund in Thailand and how to get tax refund in Thailand? Then remember to save the tax-free shopping in Thailand and the tax refund procedure when shopping here in this article!

- All about tax refund in Singapore. How much & how to get tax refund in Singapore

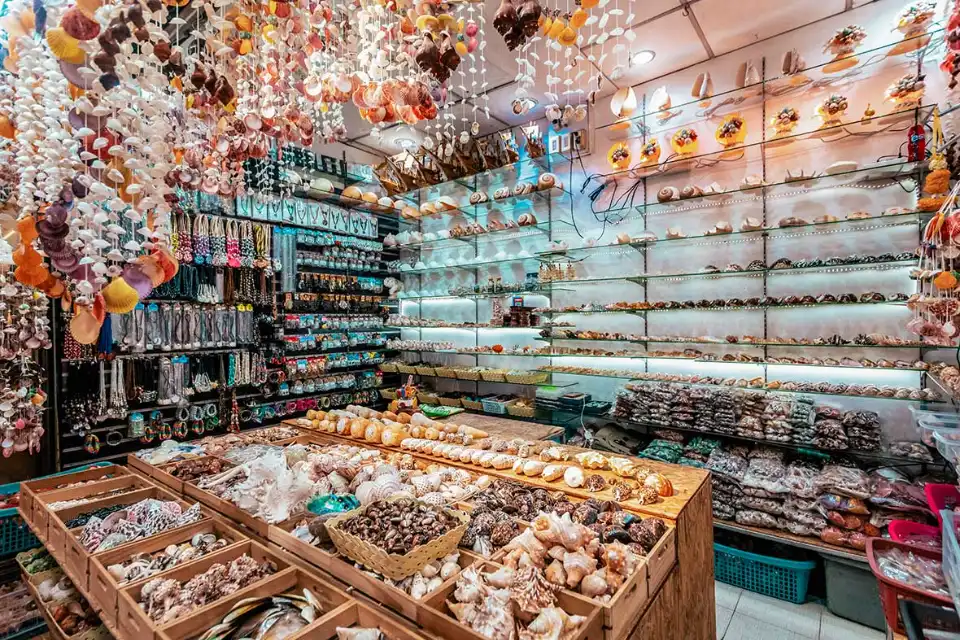

- What to buy in Phuket? — 13+ best things to buy in Phuket & where to shop in Phuket

- What to buy in Thailand? — 15+ top souvenirs to buy & best gifts from Thailand

- Explore Terminal 21 Bangkok — One of the best places to visit in Bangkok

- How to get around Bangkok by BTS Bangkok, MRT Bangkok & Bangkok Airport Rail Link?

For shopping enthusiasts, Thailand is definitely a destination not to be missed. The land of the Golden Temples is famous as a tourist paradise with countless beautiful landscapes, delicious food, and many bustling shopping areas. Here, you will find many products from high-end to affordable such as clothes, cosmetics, health products.

There are so many attractive products you want to buy in Thailand, but need to save money? Don’t worry, follow the article below. We will guide you on how to shop tax-free in Thailand, the conditions and simple tax refund procedures. Find out now to get ready for your upcoming trip!

How Much is the VAT Rate in Thailand?

Value Added Tax (VAT) in Thailand is 7% for most goods and services. This is the standard rate that visitors will encounter when shopping. This tax rate is clearly displayed on invoices and prices of products.

However, there are also cases where you will see a VAT rate of 0%. This does not mean that the goods or services are not subject to tax, but that they are exempt from tax or have a 0% tax rate.

These cases include:

- Exported goods and services: If the goods are exported out of Thailand, they are not subject to VAT.

- Services provided in Thailand but consumed entirely abroad: For example, hotel accommodation services for foreign tourists, if the entire cost is paid for abroad.

- International air transport services or international sea transport services: These transport services are usually exempt from VAT.

- Supply of goods or services between bonded warehouses or between businesses located in free trade zones: Internal transactions within these zones are not subject to VAT.

Can Tourists Shopping in Thailand Get a VAT Refund?

International tourists shopping in Thailand can get a VAT refund, but they need to meet a few conditions. First, you must not be a Thai citizen and not a resident. Additionally, you must not be a member of the flight crew on duty. Finally, you must depart Thailand from an international airport.

If you meet all of these conditions, you will be entitled to a partial refund of the VAT paid on your purchases. Remember to keep your original receipts and check in at the airport customs before boarding your flight to get your tax refund. Refund rates may vary depending on the store and their policies, so do your research before you shop to ensure a smooth refund process.

Tourists eligible are for VAT Refund in Thailand (#how to get tax refund in Thailand)

To get a VAT refund when shopping in Thailand, tourists need to pay attention to some conditions. First of all, only buy goods at stores with the sign “VAT REFUND FOR TOURISTS” to ensure that the store participates in the tax refund program. Goods must be taken out of Thailand within 60 days from the date of purchase, and you need to keep your plane ticket as proof.

Each day, at each store, the total value of purchased goods must reach a minimum of 2,000 baht (including VAT). When making a purchase, present your passport and ask the staff to issue a “VAT Refund Form for Tourists” (P.P.10) along with the original invoice. This is a very important document for tax refunds.

Before checking in, you need to present the goods, P.P.10 Form and original invoice to customs for inspection. For luxury goods (jewelry, gold, watches, glasses, pens, etc. worth over 10,000 baht), you need to bring them with you and present them at the VAT Refund Office after passing through immigration control.

Finally, you can receive your refund at the tourist counter at the international airport, drop your documents in a collection box, or mail them to the Thai Revenue Department. Complying with these regulations will make the refund process easier.

Non-Refundable Items in Thailand

When shopping in Thailand, visitors should note that not all items are eligible for value-added tax (VAT) refunds. According to regulations, services such as accommodation, meals, transportation, or consumer goods such as food and beverages are not eligible for tax refunds. Instead, only tangible items for personal use such as clothing, accessories, electronics, or souvenirs are eligible.

Additionally, to qualify for a refund, goods must be purchased from shops participating in the VAT refund program, which is usually identified by a specific sign or notice. Travelers should check this information before making a payment to ensure their rights. Some other items may be excluded due to special regulations or customs restrictions, such as goods that are prohibited from export or are on the restricted list of Thailand and your country.

To avoid unnecessary mistakes, visitors should carefully read the information about the conditions, exceptions and instructions from the store staff or the tax refund service at the airport. Understanding these regulations will not only save you time but also optimize the amount of tax refund received, bringing a more complete shopping experience in the Land of Golden Temples.

How much tax refund will I get in Thailand?

The VAT refund rate in Thailand is not fixed but depends on the total value of the purchase. For example, with a bill of 2,100 baht, you will be refunded about 80 baht. If you buy at a store with a total value of 51,000 baht, the tax refund amount can be up to 2,710 baht. For larger purchases, for example from 200,000 baht or more, the tax refund rate can reach 6.1% of the purchase value.

However, it is important to note that there will be significant administration fees associated with the refund process. Additionally, depending on the method of receiving the money (e.g. bank transfer, cash pick-up), you will be charged additional fees. This means that the actual amount of tax refund you receive may be lower than the amount originally calculated.

Documents Required for VAT Refund in Thailand

To get a VAT refund in Thailand, visitors need to prepare the following documents. Missing any of these documents may result in a failure to receive a refund or delay in the refund process.

- Original invoice: This is the most important document. You need to keep all original invoices from stores participating in the VAT refund program. The invoice must clearly state the amount of VAT paid and the store’s VAT registration number. Note that photocopies of invoices will not be accepted.

- Passport: A valid passport is proof that you are a non-resident tourist in Thailand. The name on your passport must match the name on the invoice. Make sure your passport is still valid.

- Airline ticket/Boarding pass: You need to prove that you have left Thailand. An airline ticket or boarding pass with a clear departure date and time is required.

- VAT refund form: Some shops or tax refund counters will ask you to fill in a VAT refund form. This form usually requires personal information such as your name, passport number, address and details of the items purchased. Please fill in the information completely and accurately.

- Payment method information (if applicable): If you choose to receive your refund via credit card or bank transfer, you will need to provide details of this payment method.

Steps to Get a Tax Refund When Shopping in Thailand (#how to claim VAT refund in Thailand)

Getting a value-added tax (VAT) refund in Thailand for tourists is not too complicated if you understand the process. Here are the specific steps for you to do it easily:

Step 1: Shop at Duty Free Shops

First, you need to look for shops that participate in the tax refund program. These shops usually have signs with words like “VAT Refund for Tourists” or a related symbol. If you are unsure, ask the staff for confirmation. Note that only these shops can provide valid invoices for tax refund procedures.

Step 2: Select Eligible Items

Not all items are eligible for tax refunds. Only tangible products for personal use such as clothing, electronics, accessories, or souvenirs are eligible for tax refunds. Consumer products such as food, drinks, or services such as hotels, transportation are not eligible.

Step 3: Request a Tax Invoice or Receipt

When paying, ask the store to provide a tax invoice or VAT receipt. This invoice must include:

- Name and address of the store.

- Tax registration number of the store.

- Amount of VAT paid.

- Details of the products you purchased.

- If the store does not automatically provide a tax invoice, you should ask the support staff at the time of purchase.

Step 4: Fill in the Tax Refund Form When Shopping

Some stores or tax refund counters will provide a VAT refund form. You need to fill in the required information completely and accurately, including your name, passport number, address and details of the items purchased. Please check the information carefully before submitting.

Step 5: Submit Application at the VAT Refund Counter

Before leaving Thailand, you must go to the VAT refund counter at international airports or designated locations. Here, you need to submit the following documents: original tax invoice, passport, air ticket/boarding pass and tax refund form (if applicable).

Step 6: Confirm and Receive Tax Refund

The staff at the tax refund counter will check the documents you provide. After verifying the information and tax refund amount, you will receive the tax refund in the method you have chosen (cash, bank transfer or credit card). Processing time may vary depending on the number of people and the tax refund method.

Step 7: Leave Thailand

You must leave Thailand within the prescribed time after completing the tax refund procedure. If requested, present your air ticket or boarding pass as proof of departure from the country.

Note: The VAT refund process can be complicated and time-consuming. Therefore, prepare all necessary documents before going to the tax refund counter. Please carefully study the regulations and conditions for tax refund before shopping to avoid unnecessary risks. If you have any questions, please contact the store staff or the staff at the tax refund counter for support. Following the correct procedure will help you receive your tax refund quickly and conveniently.

Tax Refund Methods for Tourists in Thailand

Tourists in Thailand can choose from many forms of receiving VAT refunds, depending on the amount of tax refund. For tax refunds under 30,000 baht, you can choose to receive cash (in Thai baht), or receive in the form of a check (4 currencies are accepted: USD, EURO, GBP, JPY) or transfer directly to your credit card account (VISA, MASTERCARD and JCB).

If your refund is over 30,000 baht, you can only choose to receive the money via cheque or credit card transfer (as mentioned above). Please note that fees such as cheque issuance fee, transfer fee and postage fee (if any) will be deducted from the refund amount. Therefore, the actual amount you receive may be lower than the originally calculated refund amount. Please read carefully about these fees before choosing a method of receiving money to plan your spending wisely.

Suggestions for Duty Free Shopping in Thailand

Thailand is famous for its diverse shopping experiences, from vibrant traditional markets to modern, luxurious shopping malls. Whether you are looking for traditional handicrafts, modern electronics or luxury goods, Thailand has it all. Here are some suggestions for notable shopping locations where you can find many duty-free shops:

Central World Shopping Mall

Thailand’s largest shopping mall, Central World is a shopping paradise with modern architecture, a massive scale spread over seven floors. It is home to a series of famous international brands, from high-end fashion to cosmetics and luxury accessories. You can easily find your favorite branded items here, and most likely you will come across duty-free shops located in this complex. The luxurious and convenient space of Central World will bring you a classy shopping experience.

Central Embassy Shopping Mall

With its sophisticated design and prime location, Central Embassy Shopping Mall is an ideal destination for fashionistas who love luxury brands such as Michael Kors, Prada, Givenchy, Gucci and Versace. In addition, this shopping mall also has many high-class restaurants and diverse food courts, meeting all the needs of customers. The possibility of finding duty-free shops here is also very high.

Terminal 21 Shopping Mall

Different from traditional shopping malls, Terminal 21 impresses with its unique airport theme and design inspired by famous cities around the world. The harmonious combination of entertainment and shopping, along with a variety of brands, from international to local, will surely satisfy the most demanding customers. Finding duty-free products here is also easier thanks to the modernity and organization of the shopping mall.

Central Festival Mall Pattaya

Located next to the beach, Central Festival Pattaya Mall stands out with more than 350 shops, displaying international and local brands. This shopping mall also has a rich food court and a modern entertainment area. It is possible to find duty-free items here.

Thailand is not only attractive for its beautiful beaches and ancient temples, but also for its diversity and abundance of shopping options. To enjoy the VAT refund offer, remember to keep your purchase receipts from participating stores, and complete the tax refund procedure at the airport before departure. Plan your trip to Thailand today and enjoy many memorable, economical and exciting shopping experiences!

Some best day tours, trips, activities and transfer services, tickets in, to and from Bangkok you can refer to

- Bangkok City & Temples Tour by Tour East

- Classic Bangkok Tour: Floating Market, Elephant Village, Asiatique, & More by AK Travel

- Bangkok Old City Half Day Tour

- Bangkok Landmarks Day Tour: Grand Palace, Wat Pho, Chao Phraya River & More

- Bangkok Sky Train (BTS) One Day Pass

- Bangkok Suvarnabhumi Airport Rail Link (ARL) Ticket

- [Sale] Private Suvarnabhumi Airport Transfers (BKK) for Bangkok, Pattaya & More by Oriental Holiday

- Private City Transfers from Pattaya to Bangkok, Hua Hin, Koh Samet & Koh Chang

- [SALE] BTS Skytrain Rabbit Card

- Chao Phraya Tourist Boat Bangkok Hop-On-Hop-Off Sightseeing Boat

- [SALE] Chao Phraya Princess Cruise

- Floating Markets Day Tour: Damnoen Saduak, Maeklong and Amphawa

- Safari World Bangkok Ticket

- Klook Pass Bangkok and Pattaya

- Bangkok Safari World Shared and Private Transfers Service Tour

- Mahanakhon SkyWalk Ticket in Bangkok

- Chao Phraya White Orchid Cruise in Bangkok

- Ancient City Bangkok and Erawan Museum Ticket

- Private City Transfers between Bangkok and Pattaya, Ayutthaya, Hua Hin & More by TTD

- Bangkok Day Tour: Wat Pho, Wat Arun, Grand Palace and Emerald Buddha

- [SALE] 4G Sim Card (Thailand Pick Up) for Thailand

- 4G SIM Card (BKK Airport Pick Up) for Thailand (Unlimited Data)

- 4G Pocket WiFi (Bangkok and Phuket Airports Pick Up) for Thailand

- 4G Portable WiFi for Thailand from Uroaming (Unlimited Data)

Are you finding more Thailand travel guide: Tours, activities, attractions and other things? Let’s check it out our Thailand blog — The fullest Thailand travel guide for a budget trip to Thailand for the first-timers. and Bangkok Pattaya itinerary 5 days — The fullest guide for a budget trip on how to spend 5 days in Thailand perfectly.

![10 best airports in Asia in 2016 [RANKED] kuala-lumpur-international-airport-best airports in asia in 2016 by skytrax ratings](https://livingnomads.com/wp-content/uploads/2016/08/29/kuala-lumpur-international-airport-best-airports-in-asia-in-2016-by-skytrax-ratings-218x150.jpg)